Issue #44 - Mélyssa Brunet Built a Workflow System and It Won Her a Title + a Free Trip to Mexico

Plus: what 2026 is quietly asking of your firm and the IRS IT overhaul

Welcome to "Get Work Done," where we discuss the complexities of efficiently running accounting and bookkeeping firms. Brought to you by Financial Cents and delivered to your inbox every 2 weeks.

Small Change, Big Results

Every new year has this strange quiet moment, right after the noise settles. You are back at your desk, the calendar is clean again, and there is a brief window where things feel possible.

At that moment, the future you is not asking for fewer loose ends and moments where you wonder if something slipped because it lived in the wrong place.

That is why the beginning of the year matters more than we admit.

It's one of the times when switching to a better mode of getting work done doesn’t feel reactive. You're changing workflow systems because you can see where your bookkeeping or accounting firm is headed, and you would rather get there with intention than urgency.

Financial Cents exists specifically for this. It’s not a generic project management tool that you have to bend into shape for accounting work. It’s built for how firms like yours actually operate: recurring deadlines, seasonal surges, client requests that need tracking, and teams that need visibility without constant check-ins.

Maybe your current setup is still semi-functional, but if you’re being honest with yourself, you probably know where the cracks are, and those cracks don’t shrink when you add more clients or hire more people.

The firms making the switch right now don’t want to carry last year’s frustrations into this year, and you shouldn't too.

Also, you won't have to do it alone.

Our consulting team—Ryan, Will, George, Kasey—they've helped hundreds of firms make this exact switch. They'll walk you through a demo tailored to how your firm actually works, help you get set up, and make sure you're not stuck watching tutorial videos at midnight trying to piece things together.

If you’ve been burned by software transitions before, this one’s different.

Community 🫶

The Bookkeepers’ Guide to Annual Reviews With Nancy McClelland, CPA

The Bookkeepers who run strong monthly closes don’t dread tax season, and they don’t have to rely on year-end heroics.

This one-page (FREE!) Bookkeepers’ Guide to Annual Reviews, created by Nancy McClelland, CPA, gives you a repeatable framework for reviewing client financials in a way that builds trust, surfaces issues early, and makes collaboration with tax professionals easier for everyone involved.

Inside the template, you’ll get a clear technical review structure that helps you catch issues (ideally before year-end), opportunities to turn clean books into confident client discussions, and so much more.

Accelerate 2 Advisor Community By Lisa Campbell

This is a breakthrough community for bookkeepers and accountants who are still deep in the day-to-day work, but ready to step out of the technician role and start building a business that runs like a system, not a scramble.

Inside, they focus on helping you clarify your true value, tap into where your real power comes from, and learn how to call in what you actually want: more time, money, and freedom. It’s about setting intentional goals, taking aligned action, and learning how to present your business in a way that feels right for you.

H🔥t today

IRS IT overhaul set to finish by 2028

After decades of attempts, the modernization of the IRS’s information technology systems will be completed by 2028, according to former Acting IRS Commissioner Michael Faulkender.

Faulkender, who served as deputy Treasury secretary and acting IRS commissioner for several months in 2025, said the modernization of the IRS's IT systems previously focused on translating millions of lines of computer code written in languages like Fortran developed in the 1950s into more modern languages.

In the past year, the focus of modernization shifted to getting systems to talk to each other and to have an overarching [application programming interface (API)] where all of the information was simultaneously available.

There was no mention of the IRS job cuts, which included 2,163 IT staffers, or 25% of that business unit, according to a May 2025 report from the Treasury Inspector General for Tax Administration. In addition, 48 senior IT employees were placed on administrative leave in March 2025 due to reorganization plans.

CFOs signal crucial role that technology will play in 2026

If you thought technology was already a big deal in finance, 2026 is about to dial things up.

A new report reveals a major shift that tech is no longer just a tool to speed up but a core to how finance leaders plan to compete. Think AI, intelligent automation, and smarter systems that do more than track work. We’re talking predictive tools, faster decisions, and CFOs taking a more strategic seat at the table.

What’s interesting is how many of them are now planning to invest in new tools and rethinking how finance should function entirely.

While the confidence is high, the pressure is real. Faster decisions, fewer errors, and better business alignment are now baseline expectations.

The question is: are you keeping pace with the finance function your peers are building?

Swipe this workflow template

Swipe this 1099 Preparation Workflow Template by Jami Dorman

Get more templates from firm owners like you in our community template library.

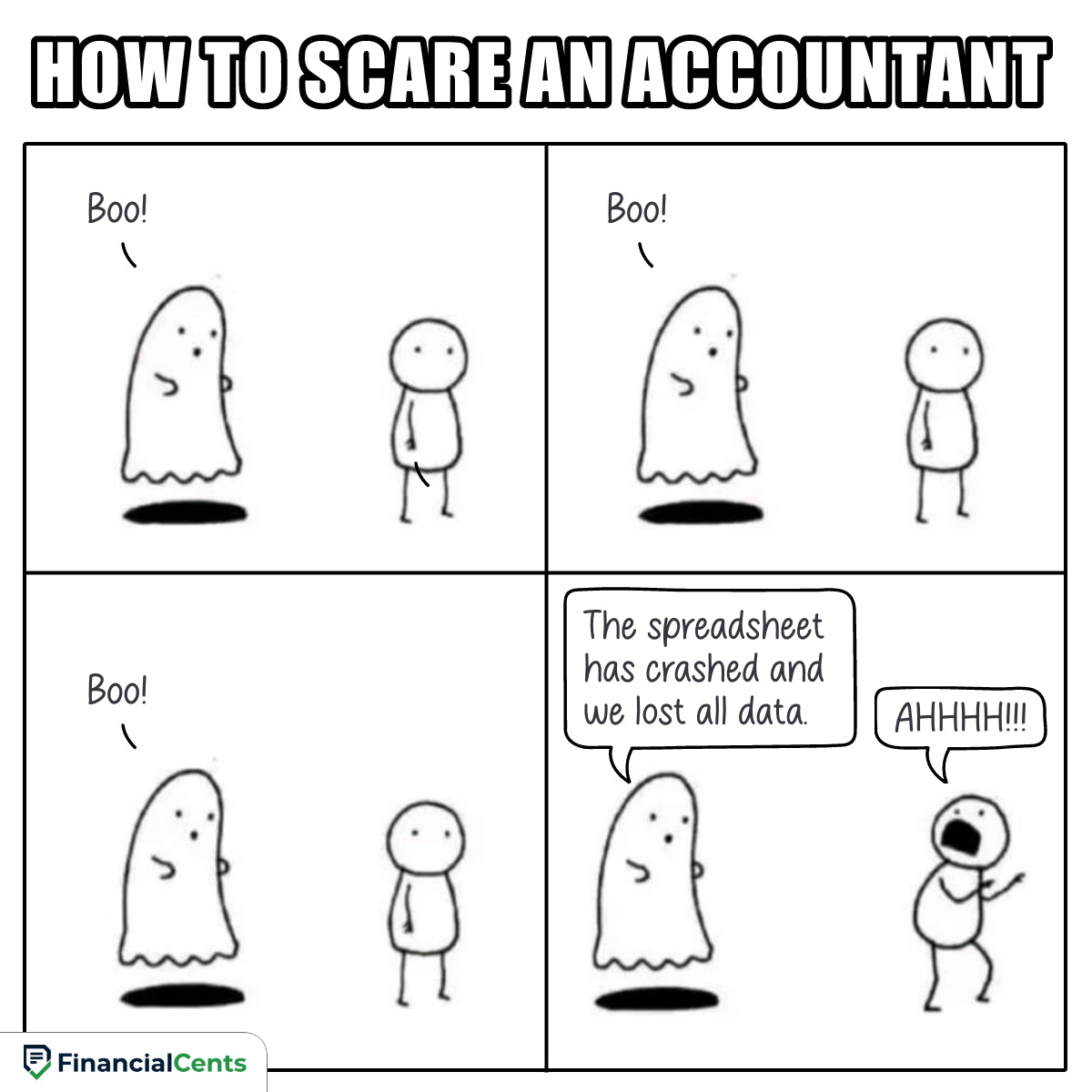

Meme

Relatable?😆

Firm Spotl💡ght

How L&L Bookkeeping Manages More Clients and Delivers Services That Drive Referrals

For Lori Hawkins, what began with helping her entrepreneur husband get cleaner books and clearer insights for smarter business decisions grew into L&L Bookkeeping, LLC in 2018.

Today, the L&L Bookkeeping team assists clients both inside and outside the U.S. with all accounting services except tax returns.

As an outsourced accounting department, they work within their clients’ teams to monitor finances and ensure compliant financial records and quality financial advice.

Managed in an all-in-one practice management tool, the firm has optimized its workflows to meet client deliverables and manage client relationships effectively. This has earned them enough referrals to keep a running list of businesses waiting to use their services.

Events

📍Profit Machine Live - Free Virtual Summit (January 29, 2026)

Profit Machine Live is a free, one-day virtual summit helping accountants grow beyond tax season.

You'll learn how firms are successfully adding advisory services like Tax Advisory, CAS, IRS Representation, and high-ticket advisory from experts who’ve actually done it.

This is an opportunity to get impactful and actionable insights from thought leaders in the accounting industry, like Dawn Brolin, CPA, CFE, Michelle Weinstein, Eric Green, and more.

P.S.: You can get up to 6.0 CPE credits.

Noteworthy

How Mélyssa Brunet Built a Workflow System That Won Her a Title and a Free Trip to Mexico

When Melyssa Brunet was announced as the 2025 Workflow Champion at WorkflowCon, the applause was immediate.

Her winning workflow, a structured year-end review process, resonated with firm owners who recognized the quiet damage caused by missed deadlines, reactive planning, and processes that live only in people’s heads.

However, Mélyssa’s story is not about a single template.

It reflects how workflows evolve when they are built with intention, tested in real client work, and shaped by the people who use them every day.

In this chat, Mélyssa walks through what pushed her bookkeeping firm to formalize workflows, how she earned team buy-in, where workflows still fall short, and why structure has become one of her firm’s biggest growth levers.

Excerpts

Q: Many firms see workflows and SOPs as efficiency tools. From your experience, what else do they influence?

Mélyssa:

Growth, without question. When we hire someone new, they are assigned files immediately in Financial Cents. They can see exactly what tasks they own, what each task means, and what done looks like. That shortens the time it takes for new hires to feel confident.

Q: You mentioned you have many templates. Why was the year-end review workflow the one you chose to present?

Mélyssa:

We actually have a library of over 50 procedures. The year-end review stood out because….

How to inform your clients about a price increase (plus a free template)

Well, it's 2026, and yesterday's price isn't today's price.

You’re delivering more value than ever, your workload has increased, and it costs more to run your firm today than it did a year ago.

Maybe you’re still hesitating because you’re unsure how clients will react, but the truth is, your firm can’t remain sustainable or profitable if you never update your pricing. Contrary to your concern, most clients will accept the new rates as long as you communicate the change clearly and professionally.

Proper communication is what determines whether clients understand the increase and continue working with you, or whether they feel blindsided and start questioning the relationship.

Till next time,