Issue #36 - Their Emergency Is Not Your Urgency

the art of choosing yourself, Mike's journey on a nuclear submarine + a tasty shot at upgrading your tech stack

Welcome to "Get Work Done," where we discuss the complexities of efficiently running accounting and bookkeeping firms. Brought to you by Financial Cents and delivered to your inbox every 2 weeks.

Small Change, Big Results

Could it be that the reason clients take your kindness and availability for granted is because you haven't built your boundaries as tall as they should be?

You want to help and serve, and saying “no” feels like you’re letting people down. But without boundaries, your time, energy, and sanity will disappear.

One of the quickest ways to create boundaries is to decide what’s off the table. Logan Graf, CPA, calls this getting crystal clear on what you’re not going to work on.

For example, Logan avoids diving into unfamiliar tax laws outside his area of practice. Why? Because learning those laws might take hours and he could better spend that time on other high-impact tasks. The same goes for services outside your core expertise. Just because a client asks doesn’t mean you have to say yes.

Another change you can make is to create policies that set expectations. Think of them as your “rules of the road” for working together. They help accounting clients understand your operations, so there’s less room for confusion. For example, if clients don’t submit their documents by the informed deadline, you can’t guarantee their return will be filed on time. Setting these types of boundaries protects you from last-minute scrambles and puts the responsibility back on the client to meet your deadlines.

It is important to know that saying no is a strength. Every time you say yes to something that doesn’t align with your goals, you’re saying no to something that does.

Community 🫶

The Modern Firm Challenge by Justine Lackey

Six more days to go!

Industry powerhouse and dynamic digital educator Justine Lackey is bringing you The Modern Firm Challenge, which starts on September 15th, for free.

You’ll learn how to confidently charge premium rates, master workflows that keep clients thrilled, and market your services in a way that actually feels good. This isn’t theory, it’s how to hit six figures while working 20–30 hours a week.

If you’re ready to stop spinning your wheels and start burning rubber, join The Modern Firm Challenge and take the first step toward your most profitable year yet.

Thrive 2025—ATAP’s premier Practice Management Seminar

Join fellow accounting, bookkeeping, and advisory professionals across Canada for two days of learning, networking, and practical strategies to grow and future-proof your practice. This seminar is happening September 25–26, 2025, at the Ottawa Conference and Events Centre.

If you’re not already a member, consider joining through the Affiliate Membership, which gives you access to Thrive 2025 and other exclusive benefits.

Take advantage of this event to gain valuable insights, connect with peers, and discover innovative tools to help your firm thrive.

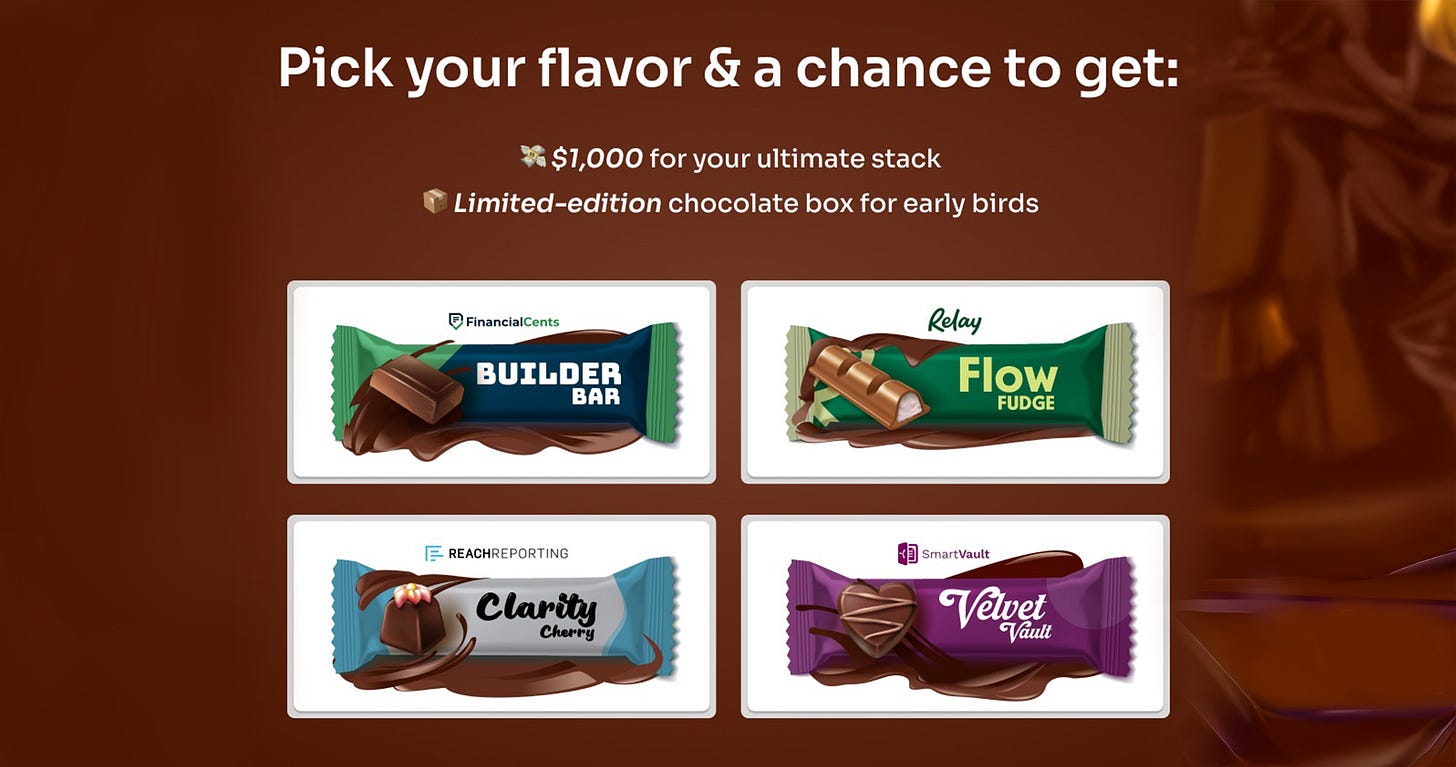

Tools, treats, and $1,000?

We’ve partnered with top accounting tools, SmartVault, Relay, and Reach Reporting, and turned them into satisfying flavors your firm will actually enjoy using.

Meet: The Flavor Stack

From smoother workflows to clearer reports, every flavor fixes a part of your tech chaos.

What's in the Flavor Stack for you:

🍫 Tools your firm will love

📦 A 5-minute quiz to find your perfect stack

💰 A shot at $1,000 to upgrade your tech tools

🍬 Get a box of custom chocolate flavors from your perfectly curated flavor stack

Ready to find your firm's flavour?

Can Amber Win $1,000 to Visit Her BFF in Arizona?

In this episode of Who Wants To Be An Accounting Millionaire, we meet Amber Thompson, the Accounting Operations Manager at L&L Bookkeeping, with one mission: win $1,000 and fly to Arizona for a long-overdue reunion with her best friend.

But before the hugs and happy tears, she’ll need to survive 10 rounds of Accounting & the Law trivia, a category known for turning confident accountants into puddles of doubt. No multiple-choice safety nets. No second chances. Just Amber, her instincts, and questions that get more ruthless with each round.

Will she make it all the way to the top?

Or will a rogue question stop her short?

Watch Episode 07 now.

H🔥t today

Bad tax advice on social media leads to $162M in IRS penalties

This is why it's good to listen to your accountants.

The Internal Revenue Service has hit taxpayers with over $162 million in penalties for claiming fraudulent tax credits they heard about through social media, Accounting Today reports.

The claims involve illegitimate claims for tax breaks such as the Fuel Tax Credit and the Sick and Family Leave Credit. The IRS has seen a surge in such claims in the past five years and warned last year about abusing them. Social media posts promoting such schemes have prompted thousands of taxpayers to file inaccurate, frivolous returns, often leading to the denial of tax refunds and hefty penalties.

Many of the posts falsely claim that all taxpayers are entitled to tax credits they don't actually qualify for, such as those aimed at self-employed people or businesses. The IRS regularly publishes and updates a list of frivolous positions on IRS.gov that could lead to penalties.

Grant Thornton Advisors to Sink $1 Billion Over Three Years on AI

Top 10 accounting firm Grant Thornton announced that Grant Thornton Advisors is investing $1 billion over three years to provide artificial intelligence tools and technology to the entire workforce at its multinational professional services platform, which stretches from the Americas across Europe to the Middle East.

According to reports from CPA Practice Advisor, the investment will help the platform deliver innovative and high-quality accounting, tax, and advisory services based on a people-centric model powered by AI. As a result, the multinational platform will be able to deliver a better end-to-end digital experience for both its professionals and its clients.

Mike Kempe, chief information officer for Grant Thornton Advisors, added, “This investment is a big step as we ensure that every person at the Grant Thornton Advisors platform has AI and technology resources at the ready—from our newest hires to our most seasoned professionals. The Microsoft 365 Copilot rollout, for example, will help our people save time, balance their workloads, and make more insightful decisions. This means they’ll be able to efficiently provide our clients with personalized high-quality services.”

Swipe this workflow template

Swipe this Bookkeeping Client Offboarding Checklist Template by Taylor Ammons.

Get more templates from firm owners like you in our community template library.

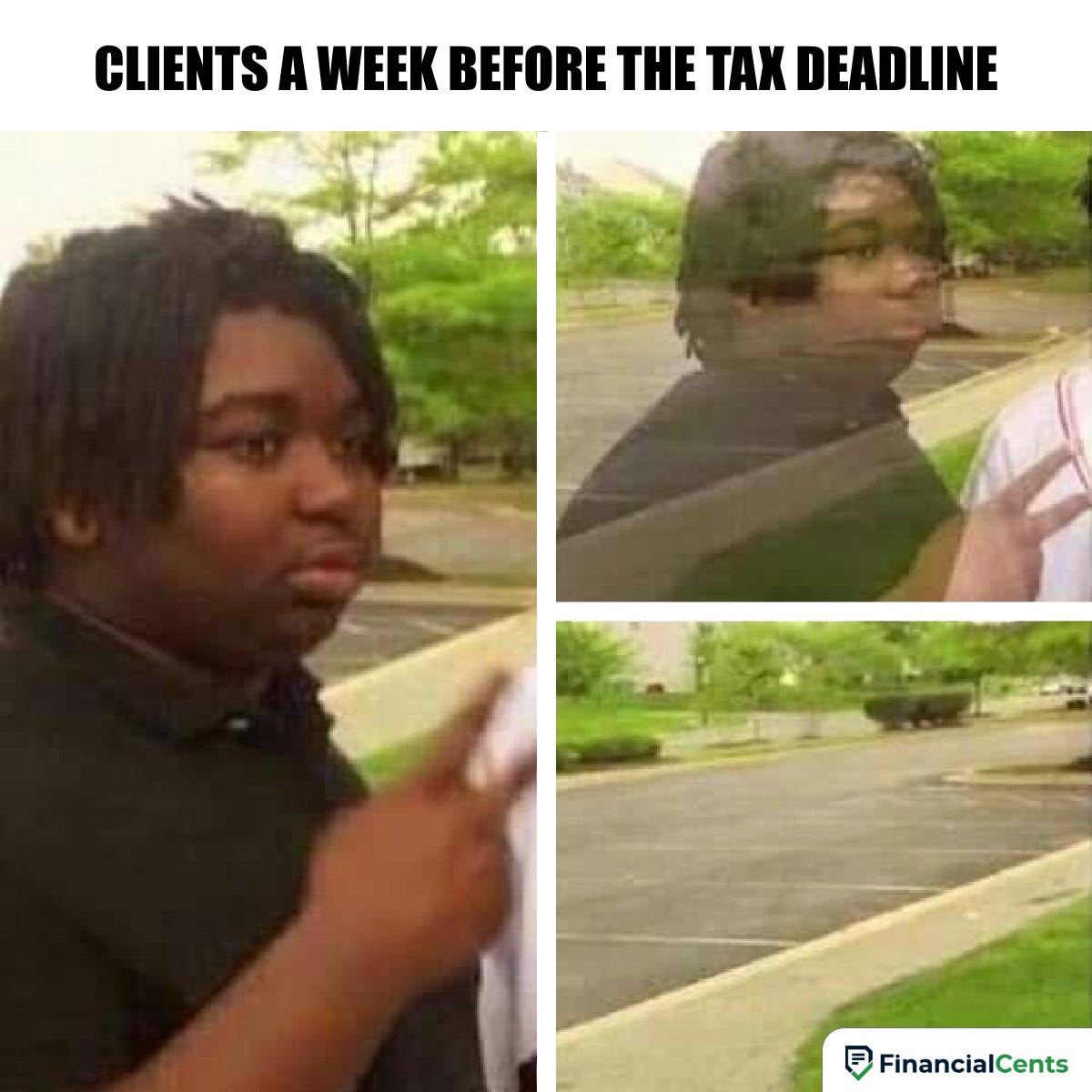

Meme

Relatable?😀

Events

📍The 7-Step Client Experience That Keeps Firms Organized w/Nick Boscia, CPA - September 16, 2025 (Virtual)

Join Nick Boscia, CPA, a firm owner and operations expert, for a practical, step-by-step walkthrough of how modern firms are redesigning their client experience from the ground up.

Plus, you’ll see how SmartVault’s secure document storage and Financial Cents’ workflow and firm management tools work together to deliver a seamless experience your clients (and your team) will love.

📍 Pre-Register For Workflowcon 2025 – November 11 - 12, 2025 (Virtual)

WorkflowCon 2025 is coming! 🚀

Last year, we had over 1500+ attendees who walked away with actionable strategies to scale their firm, and this time, we’re trading burnout for breathing room.

What you can expect:

✅ Proven strategies to tame workflow chaos

✅ Learn from the best in the accounting industry

✅ Tailored sessions for every firm size

✅ The return of the Workflow Awards

✅ Unveiling the 2025 FC Champions

Two days. One simple goal: clear the chaos and find your calm.

Pre-register now to get early access to the speaker lineup, agenda, and VIP perks.

Noteworthy

Skilled for success? Accounting newcomers say yes, managers say no

Regarding the skills needed to succeed in accounting and finance roles, less-experienced employees and their managers aren’t on the same spreadsheet.

Accountants in their first five years of employment in the profession, recently surveyed by the Illinois CPA Society (ICPAS), gave themselves an average score of 7.39 out of 10 across 37 preparedness skills. Managers who oversee employees in their first five years gave the workers an average score of 4.95.

While employees collectively rated themselves above 7.0 on 30 of the 37 skills in the ICPAS survey, managers didn’t rate employees at 7.0 on any skill, and rated them above 6.0 on just one (“working with spreadsheets to manage large data sets and apply formulas”).

“The goal of our research was to better understand how prepared early-career professionals feel and how their managers perceive their readiness,” Geoffrey Brown, ICPAS president and CEO, said in a news release. “We hope these findings will spark action and inspire profession-wide conversations that shape new strategies, resources, and support systems that’ll help early-career accounting and finance professionals grow and thrive.”

Mike Sylvester Has Worked on a Nuclear Submarine, Traveled to 37 Countries and He Isn't Stopping Anytime Soon

From going into depths below the polar ice to building SBS CPA Group and leading a thriving community of accountants through The Collaboration Room, Mike’s life has been anything but ordinary.

His travels have taken him to some of the world’s most breathtaking destinations, but they’ve also brought him face-to-face with stark realities.

In Brazil, he witnessed the extreme poverty that many children endure. “I remember watching children digging through trash for food in Rio de Janeiro,” he recalls solemnly. “It’s a moment I’ll never forget. Seeing that kind of poverty makes you appreciate the privileges we often take for granted. It gives you perspective.”

His love of travel has always been central to his life and has influenced his family’s journey. Mike and his wife, Karena, have taken their children on countless adventures around the globe, helping them see life from a broader lens. “My kids have been to 20 foreign countries,” he says with pride. “We wanted them to grow up understanding that the world is vast and full of diverse people, stories, and ways of life. I think it’s one of the best gifts we could give them.”

With retirement on the horizon, Mike is already planning his next chapter.

“I’ve been to 37 countries, but I want to add five to ten more each year when I retire,” he says, smiling. “We’ve saved some easier places, like England and Ireland, for when we’re older. We’re keeping the more rugged destinations for now.”

What Are Your Thoughts?

Share your POV in the comments.

You can also join the FC Reddit community here.

Until Next Time,