Issue #32 - The Riches You Want Are in Niches You Avoid

+ how to make hard strategic decisions for your firm

Welcome to "Get Work Done," where we discuss the complexities of efficiently running accounting and bookkeeping firms. Brought to you by Financial Cents and delivered to your inbox every 2 weeks.

Small Change, Big Results

The firm owners charging $2,000/hour aren't smarter than you.

They're not more talented, and they don't have fancier degrees.

They just figured out that riches are in the niches. (Yes, we know it's cheesy, but it's true.)

Many accounting firm owners resist niching because they fear it will limit opportunities or reduce their potential client base. They believe that casting a wider net will attract more business, but in reality, the opposite is true.

What if you run an accounting firm where every client you take on is the perfect fit? Where your processes run so smoothly that you save time, increase profits, and scale effortlessly.

Zane Stevens learned this lesson firsthand when he started Protea Financial. At first, he and his team took on a broad range of clients—from attorneys to music festivals to beauty product companies. They were doing good work, but their firm lacked a clear identity.

“We didn’t say on day one we will only help wineries,” Stevens admitted. “But what we could show to people that were referral sources was that we work with wineries and we understand the space.”

Niche accounting firm owners say niching has allowed them to move away from being generalists to becoming experts.

It is the difference between being just another accounting firm and being the go-to accounting firm for their chosen industry. It's why they can charge higher fees because clients are willing to pay for the specialized expertise.

They know they are getting a tailored, high-value service. If you're still on the fence and wondering if picking a niche might limit you, consider this: Do you want to be the Jack of all trades or the master of one?

At WorkflowCon 2024, Zane Stevens shared his 7-step approach to niching and streamlining his business, which made his firm a dominant force in the wine industry.

Check it out.

Community 🫶

Join The Fundraising Accountant Community by Stephen King, CPA

If you're a nonprofit leader or changemaker in the accounting space, this is the community for you. Founded by Stephen King, CPA, this is a community to learn new strategies, get support from others facing similar challenges, and build a network that can help your organization succeed. If you’re looking to boost your fundraising and be part of a group that’s rooting for your growth, this is the perfect place to start.

You also have access to a learning library, community QnA sessions, fundraising templates and a lot more.

Who’s Got the Bandwidth? This Capacity Planner Spills the Tea.

The Capacity Planner is a decision-making tool built in collaboration with leading accounting workflow experts, informed by insights from serving over 10,000 accountants and bookkeepers, and powered by data from Financial Cents’ annual State of Workflow & Automation Report.

It was designed with one goal: to help you understand your firm’s operational bandwidth before it becomes a bottleneck.

In 10 minutes, this simple, guided quiz reveals the cracks before your deadlines do.

H🔥t today

Strategic Planning Isn’t Optional Anymore

There has never been a time when carefully planning out the future of your firm has been so important. While it's easy to feel like you’re making progress because your calendar is packed and your team is heads-down, busyness isn’t the same as direction.

In a recent Accounting Today podcast episode, Matt Rampe of Rosenberg Consulting offers a refreshing take on what strategic planning looks like for accounting firms, and no, it doesn’t involve a three-day retreat or a 40-page PDF that no one reads again.

For most accounting firms, this might look like starting with low-friction ways to gather honest input from the team, without triggering eye-rolls or meeting fatigue. It means being willing to face the hard decisions you’ve been avoiding, whether that’s letting go of outdated services or rethinking capacity. And more importantly, it’s about treating strategy as something you do consistently, not a once-a-year checkbox.

Listen to the conversation here →

The 2025 Tax & Accounting Technology Innovation Awards

The CPA Practice Advisor Tax & Accounting Technology Innovation Awards honor new technologies that help accounting firms and their small business clients operate more efficiently and profitably through improved workflow, increased accessibility, or enhanced collaboration.

Now in their 22nd year, the Innovation Awards highlight technologies shaping the profession and small businesses through increased collaboration and productivity. These tools allow firms to better manage workflows, be more productive and secure, and engage with clients in ways that are convenient and productive for them as well.

Award selection process: Each year, the awards committee votes to announce five winners. Additional technologies are also recognized as award finalists. The awards are not ranked or divided into categories. All nominated products and services meeting the submission requirements can be awarded as award winners or finalists.

The deadline is August 22, 2025.

Nominate your favourite tech here →

Swipe this workflow template

Swipe this Potential Client Lead Tracking Checklist Template by Stephanie Ramirez.

Get more templates from firm owners like you in our community template library.

Meme

Relatable?

Events

📍The 2025 Tax Retreat – July 18 & 19 (Denver)

T-minus one sleep until tax professionals take over Denver!

The Tax Retreat returns to its birthplace for round three of what happens when #TaxTwitter decides conferences should actually be fun. Think less "mandatory networking mixer" and more "reunion with friends you haven't met yet."

Whether you're a seasoned pro or a fresh face in the tax world, The Tax Retreat promises an unforgettable experience where connections are made, laughter is abundant, and memories are cherished.

📍 NATP Taxposium 2025 – July 21-23 (Las Vegas)

Looking to stay ahead in tax? TAXPOSIUM, organized by the National Association of Tax Professionals (NATP), is where smart tax pros gather to learn, connect, and grow.

From industry hot topics to practice management breakthroughs and tech updates, you'll get the insights you need. Meet face-to-face with tax law experts and IRS reps. This year, you also get to join a community of innovative professionals who are redefining what it means to excel in tax practice.

📍 Bridging The Gap Conference – July 22-24 (Denver)

Organized by Tri-Merit, Bridging the Gap is an annual accounting conference for accounting, tax, and finance firms. The event provides a blend of innovation, networking, and professional growth, bringing together leaders and experts from across the industry.

The theme for 2025 is “Expedition Innovation: Charting New Paths in People, Technology, and Practice,” and it promises to deliver inspiring keynotes, hands-on workshops, and unmatched networking opportunities.

The Financial Cents’ team will be there and can't wait to see y’all!

Noteworthy

Accountants + Game Show = Surprisingly Good TV

You're seriously missing out if you haven’t watched the Who Wants to Be an Accounting Millionaire show yet. It's exactly what it sounds like; accountants answering trivia questions against the clock. There's real money on the line ($1,000), which keeps things interesting.

We've seen three contestants so far:

Nick Boscia, CPA, played for a trip to Japan. He handled the pressure remarkably well.

Kate Josephine Johnson wanted to win enough to take her family out for a nice dinner. She definitely knew her stuff.

Katie Thomas came in with investment plans and stayed focused throughout. Made the rest of us realize we might need to brush up on our knowledge.

You'll pick up some interesting facts, find yourself trying to answer along, and probably enjoy it more than you'd expect.

💡Firm Spotlight

From Local to 22 States: How Butler & Sanchez LLC Scaled with Structure

The story of Butler and Sanchez LLC proves that you don’t need a grand vision or well-thought-out branding to start a business. The universe can fan a small idea into flames if you know how to ride the wave and deploy the right resources (technology).

“Butler and Sanchez started as a joke in March of 2017. I needed to help out a friend and wanted to sound legitimate, so I formed an LLC in Texas because it was easy.”

Hugo C. Sanchez, CPA

Three years after this casual step, Hugo Sanchez, CPA, had seen enough clients to convince him to bet on himself and his accounting expertise. At some point, his wife, Amanda Butler, joined him.

Together with eight other accounting professionals, they provide full-service accounting solutions to businesses in 22 states in the USA.

With their entire family (and eight other households) depending on the firm for livelihood, Hugo Sanchez and Amanda Butler were determined to attract more clients and grow their profits by improving service quality and giving their staff the tools to do their best work.

This is when the limitations of their existing project management system hit them.

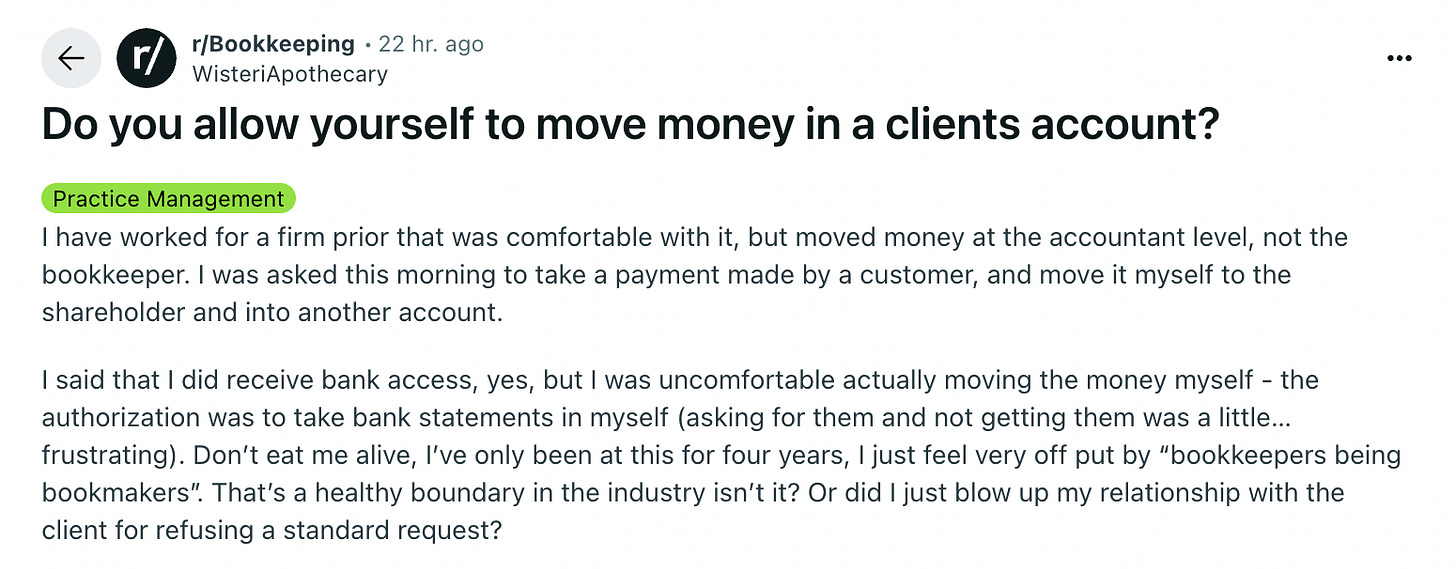

What Are Your Thoughts?

Share your POV in the comments.

You can also join the FC Reddit community here

Until Next Time,

I actually said this. We are not HR Block nor do we want to be. We are small business let's focus on businesses. Not every single person that pays taxes. Make it exclusive to be our client.